WHY SHOULD YOU INVEST IN THE KENYAN REAL ESTATE MARKET IN 2022?

Stocks, bonds, commodities, cash and even crypto are great asset classes to consider investing into. However, real estate still remains one of the best assets for investment!

Many individuals have made their fortunes from real estate investments many years ago. According to billionaire Andrew Carnegie 90% of millionaires today reach that level of wealth through real estate investments.

We aren’t all investors and frankly I wasn’t much of a risk taker until the past couple of years.

Look I get it…

It’s scary taking risks.

BUT…

There are a myriad of factors that can help us determine whether investing into real estate is worth the risk.

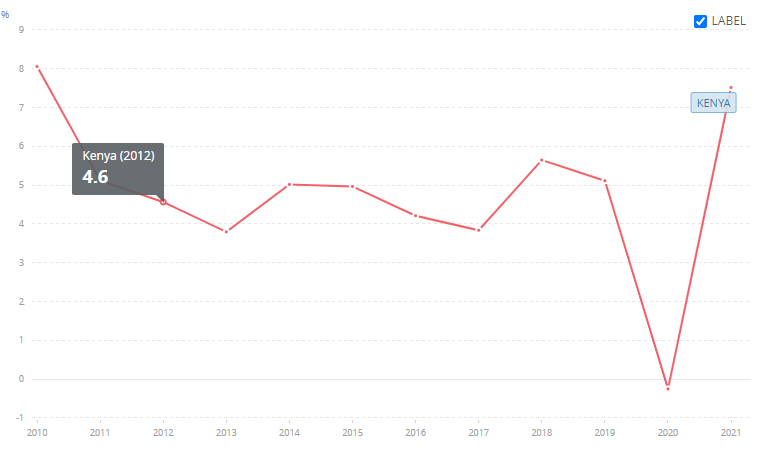

Based on research data from the World Bank – there is a steady increase of 4.82% annually in the Kenyan GDP over the last decade.

Other factors that may influence the potential for real estate investment:

- Infrastructure

- Central Hub

Infrastructure

Over the past decade we have seen a colossal shift in the infrastructure of Kenya. With the newly constructed Nairobi Express Way, the standard gauge railway (SGR) and many other mixed use developments such as the Global Trading Center (GTC) in Westlands.

The increase in infrastructure is attributed to the vast influx of foreign investors from the UK, China, USA and many other countries.

The population in Nairobi and other major cities such as Mombasa have also increased, raising the demand for residential homesteads across the country.

Real estate developers such as Rama Homes cater to the growing need for residential family homes across Nairobi. Projects such as Marina Heights, Jumeirah Heights, Rama Heights and Gateway Park are prime examples of quality affordable housing. These developments range from 1 to 4 bedroom apartments and come with a 6 year payment plan at 0% .

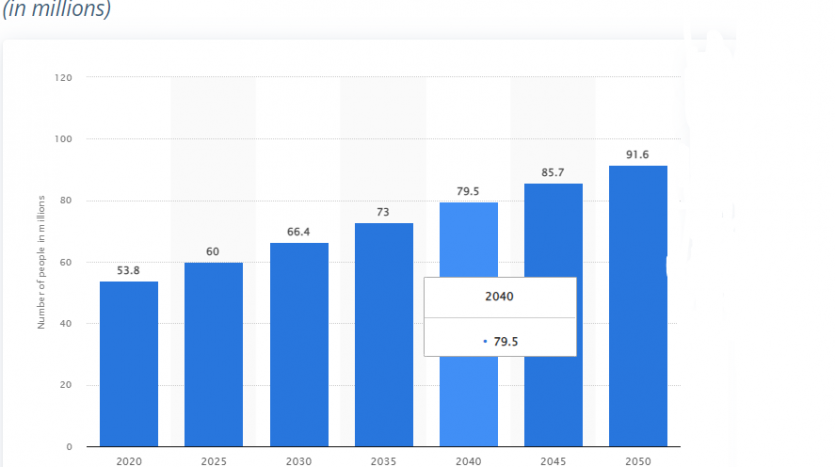

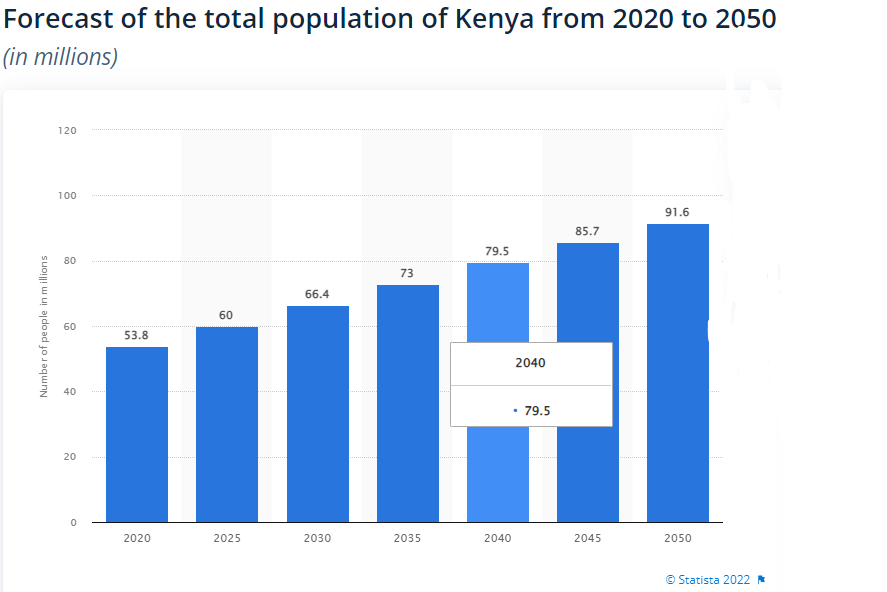

Nairobi currently has a population of 4.4 million people as of 2019. This figure is expected to increase to 91 million people by the year 2050 according to Statista. We can therefore expect to see an increase in demand for residential developments.

East African Hub

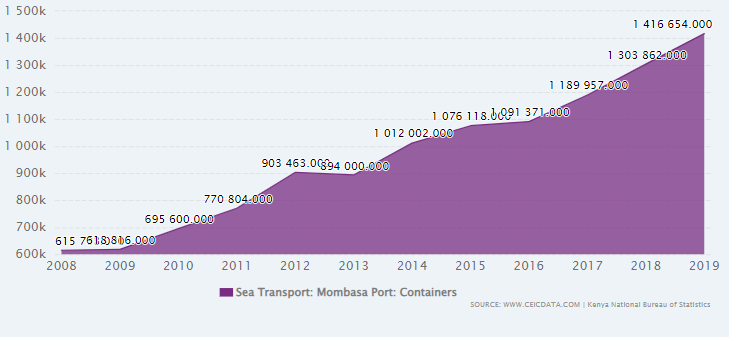

Kenya boasts the largest seaport in East Africa known as Kilindini Harbour. This port is of great importance to neighbouring East African countries such as Rwanda, Uganda, Burundi and The Democratic Republic Of Congo. According to research data the Kilindini Harbour has seen a steady increase of trade volume over the past decade.

The graph above shows how rapidly the import and export of goods has increased 770,804.000 TEU annually (twenty-foot equivalent unit).

Kenya will remain an economic giant of East Africa with it’s strategic ports that will allow other countries economies to flourish. It is only recently (2021) that President Uhuru Kenyatta welcomed The Democratic Republic of Congo’s application into the EAC. He mentioned that it would “strengthen” the East African region not economically but also in security.

“I am also delighted that the Democratic Republic of Congo has shown a strong interest to join the East African Community which I believe will further strengthen the bonds of the people of our great region,” – Uhuru Kenyatta

Market trends fore shadow a dramatic need for residential developments across major cities in Kenya.

Real estate developers such as Rama Homes play a vital role in providing quality affordable housing. They can achieve this through their uniquely crafted 6 year payment plan. Allowing prospective investors a little more time to pay back on their investment.

This provision is not only for the Kenyan citizens — but also for the diaspora and international investors who seek to grow a healthy investment portfolio.

Rama Homes currently has residential developments in Syokimau, South C, Parklands and soon Kilimani. These locations are strategically chosen because of their proximity to schools, hospitals and major shopping malls.